how to determine tax bracket per paycheck

You find that this amount of 2020 falls in the at least 2000 but less than 2025 range. Use this tool to.

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-V1-6455aa5186fe4122b592a2accb6b8f73.png)

Withholding Tax Explained Types And How It S Calculated

The state tax year is also 12 months but it differs from state to state.

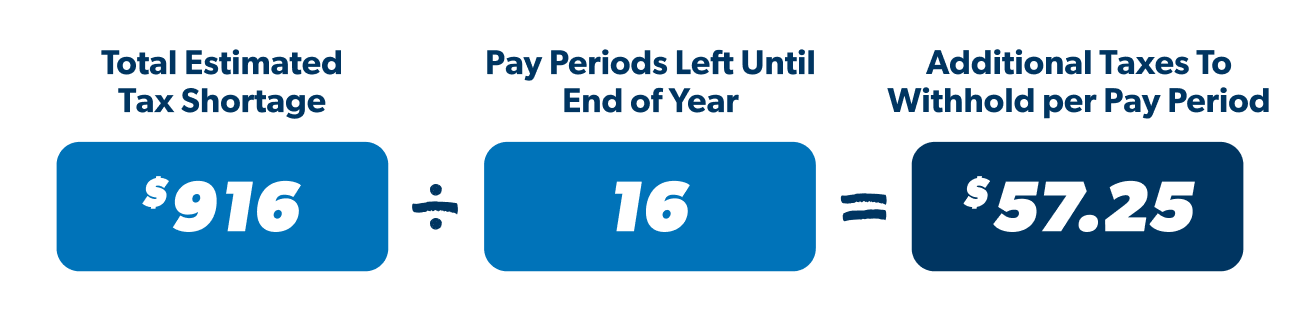

. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. For salaried employees start with the persons annual. 250 minus 200 50.

As you move up the brackets the percentage of tax increases. Calculate your paycheck in 6 steps. How It Works.

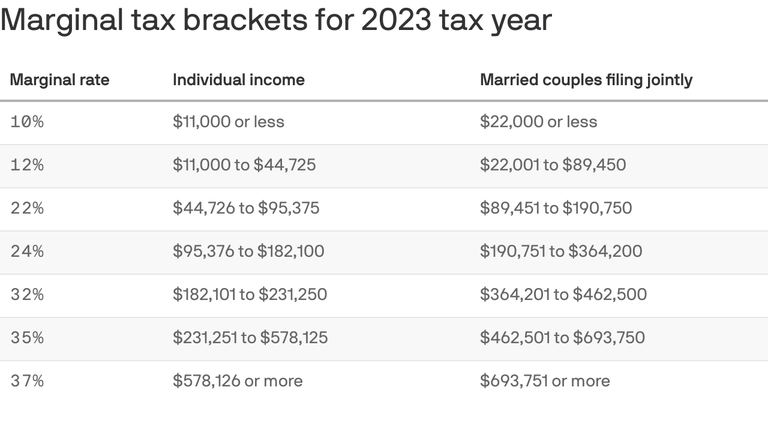

For example if a salaried employees gross pay is 40000 and you want to calculate their. Your bracket depends on your taxable income and filing. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

For example if you earned 100000 and claim 15000 in deductions then your. 2021 Federal income tax brackets 2021 Federal income tax rates. In 2022 individuals making between 41775 and 89074 pay up to 22 in federal taxes on the parts of their salary that fall into that range.

Heres how it works. The easiest way to calculate your tax bracket in retirement is to look at last years tax return. For 2020 look at line 10 of your Form 1040 to find your taxable income.

Each IRS tax bracket has a slightly different tax rate. There are seven federal income tax rates in 2022. Estimate your federal income tax withholding.

Your taxable income is the amount used to determine which tax brackets you fall into. First you need to determine your filing status. 21435 amount of tax owed 115000 total income 186 percent ETR.

The irs income tax withholding tables and tax calculator for the current year. 10 12 22 24 32 35 and 37. So while your highest tax bracket would be 24.

If your income is 996364 9964k a year your after tax take home pay would be 53923313 per year. Annual gross salary number of pay periods gross pay for salaried employees. An individual who made over 216000 as a single filer in 2022.

The total tax bill for your tax bracket calculated progressively is the tax rates per tax bracket. In the 115000 example above your effective tax rate would be. See how your refund take-home pay or tax due are affected by withholding amount.

Essentially your total tax bill will be 9875. This is 4493609 per month 1036987 per week or 207397 per day. There are six main steps to work out your income tax federal state liability or refunds.

There are seven federal tax brackets for the 2021 tax year.

What Are The Federal Income Tax Brackets Rates H R Block

How To Calculate Your Tax Withholding Ramsey

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Federal Income Tax Brackets Brilliant Tax

Here Are The Federal Income Tax Brackets For 2023

Federal Income Tax Brackets For 2022 And 2023 The College Investor

Federal Income Tax Brackets For The 2022 Tax Year Filed In 2023 Smartasset

How Do Tax Brackets Work And How Can I Find My Taxable Income

5 Tricks For Getting A Bigger Paycheck In 2021 Money

Salary Paycheck Calculator Calculate Net Income Adp

Taxes For Teens A Beginner S Guide Taxslayer

Irs Withholding Tables And A Bigger Paycheck In 2018

How To Calculate Federal Income Tax

Paycheck Calculator Take Home Pay Calculator

New York Hourly Paycheck Calculator Gusto